Types Of Calculating Cost Of Capital . the cost of capital is the rate of return expected to be earned per each type of capital provider. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. The cost of capital of a firm is. Measurement of cost of capital. Concept of cost of capital. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Types of cost of capital. Factors affecting cost of capital. the cost of capital is very important factor in formulating firm's capital structure. a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. Under this method, all sources of.

from www.slideserve.com

The cost of capital of a firm is. a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. Types of cost of capital. Factors affecting cost of capital. the cost of capital is very important factor in formulating firm's capital structure. the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Concept of cost of capital. Under this method, all sources of. the cost of capital is the rate of return expected to be earned per each type of capital provider.

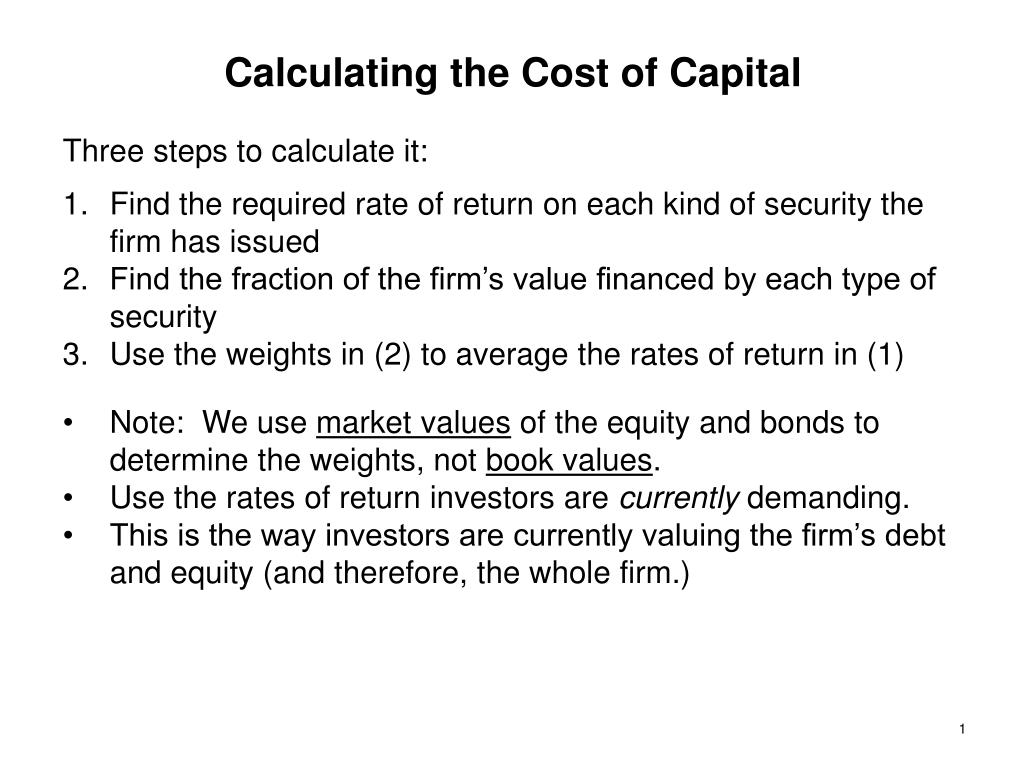

PPT Calculating the Cost of Capital PowerPoint Presentation, free

Types Of Calculating Cost Of Capital Concept of cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. Measurement of cost of capital. Factors affecting cost of capital. Under this method, all sources of. The cost of capital of a firm is. Types of cost of capital. Concept of cost of capital. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. the cost of capital is very important factor in formulating firm's capital structure.

From slidetodoc.com

Cost of Capital Problems 3 Calculating Cost of Types Of Calculating Cost Of Capital Measurement of cost of capital. the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Factors affecting cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. Types of cost of capital. in this refresher. Types Of Calculating Cost Of Capital.

From www.slideserve.com

PPT Concept and Measurement of Cost of Capital PowerPoint Types Of Calculating Cost Of Capital in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Under this method, all sources of. Types of cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. the cost of capital. Types Of Calculating Cost Of Capital.

From www.slideserve.com

PPT Cost of Capital and Returns to Providers of Finance PowerPoint Types Of Calculating Cost Of Capital in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. the cost of capital is very important factor in formulating firm's capital. Types Of Calculating Cost Of Capital.

From efinancemanagement.com

Weighted Average Cost of Capital (WACC) eFinanceManagement Types Of Calculating Cost Of Capital Measurement of cost of capital. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Factors affecting cost of capital. the cost of capital is very important factor in formulating firm's capital structure. The cost of capital of a firm is. the most common. Types Of Calculating Cost Of Capital.

From happay.com

Cost of Capital What is it, Types, Formula & How to calculate it? Types Of Calculating Cost Of Capital the cost of capital is very important factor in formulating firm's capital structure. Factors affecting cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. Concept of cost of capital. the most common approach to calculating the cost of capital is to use the weighted. Types Of Calculating Cost Of Capital.

From www.pinterest.com

WACC Formula Cost of Capital Plan Projections Cost of capital Types Of Calculating Cost Of Capital Types of cost of capital. a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. the cost of capital is very important factor in formulating firm's capital structure. Measurement of cost of capital. cost of capital (coc) is the cost of financing a project that. Types Of Calculating Cost Of Capital.

From www.equitynet.com

Cost of Equity Formula Using DDM, CAPM, and Private Companies Types Of Calculating Cost Of Capital Measurement of cost of capital. the cost of capital is very important factor in formulating firm's capital structure. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. the cost of capital is the rate of return expected to be earned. Types Of Calculating Cost Of Capital.

From npifund.com

Cost of Equity Definition, Formula, and Example (2024) Types Of Calculating Cost Of Capital the cost of capital is very important factor in formulating firm's capital structure. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Factors affecting cost of capital. a firm's cost of capital is typically calculated using the weighted average cost of capital formula. Types Of Calculating Cost Of Capital.

From www.scribd.com

Calculating Cost of Capital A Comprehensive Guide to Valuing a Firm Types Of Calculating Cost Of Capital in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Factors affecting cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. the cost of capital is very important factor in formulating. Types Of Calculating Cost Of Capital.

From www.pinterest.com

How to Calculate the Cost of Capital for Your Business Cost of Types Of Calculating Cost Of Capital in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. the cost of capital is very important factor in formulating firm's capital structure. The cost of capital of a firm is. Concept of cost of capital. Types of cost of capital. Measurement of cost of. Types Of Calculating Cost Of Capital.

From www.youtube.com

Cost of Capital Part 2 of 5 (Cost of Preferred) YouTube Types Of Calculating Cost Of Capital the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. cost of capital (coc) is the cost of financing a project that requires a. Types Of Calculating Cost Of Capital.

From www.slideserve.com

PPT CHAPTER 10 The Cost of Capital PowerPoint Presentation ID336292 Types Of Calculating Cost Of Capital Types of cost of capital. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. the most common. Types Of Calculating Cost Of Capital.

From issuu.com

The Basics For Sellers Calculcate Your Capital Gains Tax by SUSANNE Types Of Calculating Cost Of Capital the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. the cost of capital is very important factor in formulating firm's. Types Of Calculating Cost Of Capital.

From educationleaves.com

Cost of Capital Types, Component, Formula, Impact, & Importance Types Of Calculating Cost Of Capital the cost of capital is the rate of return expected to be earned per each type of capital provider. Types of cost of capital. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Concept of cost of capital. Under this method,. Types Of Calculating Cost Of Capital.

From www.slideserve.com

PPT Cost of Capital PowerPoint Presentation, free download ID662304 Types Of Calculating Cost Of Capital Measurement of cost of capital. the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). the cost of capital is the rate of return expected to be earned per each type of capital provider. in this refresher reading learn different ways of calculating the cost of debt,. Types Of Calculating Cost Of Capital.

From www.slideserve.com

PPT Chapter 11 PowerPoint Presentation, free download ID3206743 Types Of Calculating Cost Of Capital a firm's cost of capital is typically calculated using the weighted average cost of capital formula that considers the cost of both. Measurement of cost of capital. in this refresher reading learn different ways of calculating the cost of debt, the cost of equity using capm, ddm and bond yield. Types of cost of capital. The cost of. Types Of Calculating Cost Of Capital.

From www.youtube.com

Capital Cost Comparison Capitalized Cost Analysis YouTube Types Of Calculating Cost Of Capital the cost of capital is the rate of return expected to be earned per each type of capital provider. The cost of capital of a firm is. cost of capital (coc) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Factors affecting cost of capital.. Types Of Calculating Cost Of Capital.

From www.wisbees.com

What is Weighted Average Cost of Capital (WACC)? Types Of Calculating Cost Of Capital the most common approach to calculating the cost of capital is to use the weighted average cost of capital (wacc). Under this method, all sources of. Concept of cost of capital. Factors affecting cost of capital. the cost of capital is the rate of return expected to be earned per each type of capital provider. The cost of. Types Of Calculating Cost Of Capital.